Excel Sheet For Fundamental Analysis (Checklist)

Investment in a fundamentally strong company has the potential to gain immense returns to the investor, past decade we had many examples like Wipro, Asian Paints, Titan and so on. Fundamental investment is actually way better than trading because in the long term value of the asset increases over the years and there is no such think like quick money or a shortcut. There is a process that we have to learn if we want to shine. I have prepared a checklist that can help you guys can analyze the stock yourself. In this post, I am going to explain the importance of the points included in the sheet.

EPS- Earning Per Share shows companies profitability per share, more EPS more better company. It should be in increasing trend in past few years, if it is decreasing, or same then there might be a problem or have very low growth with the company.

Revenue-I think it is already understood that revenue should be an uptrend, especially on year on year basis.

Operating Profit - It is the same as revenue, and should be in increasing trend with at least double-digit performance (more than 10%) year on year.

Reserves- are the profit earnings that the company has kept aside for future use in any way, Increasing better over the years.

Total Debt (Long and Short Term)- this means a loan or borrowing the business has taken from outside lenders & banks. It is taken as a negative point if the year-on-year debt is rising, it should be stagnant or decreasing shows. It includes both current & non-current loans.

Share Capital- is the amount that we raise from investors to run a business, if a company is able to make money from the core business then there is no need to raise more capital. If the share capital is rising then it is actually negative news, stagnant is good, and decreasing is very positive. In the case of decreasing, the company is not dependent on share capital anymore so it started returning investors money by processes like “Buyback“ etc.

Promoter Holding- There should be a good percentage of the stake of the promoter to keep his/her interest in the company. If the promo has less stake then he may not take the company seriously and if the promoter’s stake is decreasing year on year then it is a very negative indication as the promoter has all sorts of inside information, if something negative has to happen to the company then promoter will encash his/her stake. And if it is increasing then taken as a positive sign.

Promoter Pledging Holder- Promoter borrows money in exchange if shares, this is also taken as a negative point if this percentage is increasing and taken as positive if decreasing

Other Income- Company is considered to be good if it is earning from core business only, if the company mainly earns from other businesses then it means the company is dependent and not good in its own business, no investors would like to invest in this case. Other income should be a very minimal or a small percentage of profit.

Chart performance- It is one of the most important aspects, there are 3 types of major trends- Downtrend, Consolidation and Uptrend, one should buy stocks at the end of consolidation for more return & less time. Investors run out of time always not money, it is always more sensible to take entry and exit & the right time.

Sector Performance- CAGR growth of that particular should be around 9-10%, and sector growth is a must for stock growth.

Business Model- it must have an X-factor (unique factor) that other companies lack. If a company has a similar business model to the competition then the profit will be super-thin and shares will not grow.

Market Capitalisation- Generally investors tend to invest in small-cap and mid-cap as they have more potential to become large cap in the coming decade or so, Example- If Reliance wants to double their valuation then they have to provide much more value than that whereas Happiest Minds just grew 5 times in less than a year. Small and good companies grow fast. Companies that have a capitalization of less than ₹5000 Crore are called Small Cap, ₹5000 - ₹20000 Crore companies are called Mid Caps and more than ₹20000 Crore are called Large Caps.

PE Ratio- In simple words PE (Price To Earning Ratio) is an aspect where we measure📐 rather the company is expensive or not. Check this Article to understand in depth. A company that has PE 0-10 is considered to be a jackpot, 20-30 is considered as fairly valued and more than 30 is highly-priced. Keep in mind that if the company’s business is exceptional then PE can be avoided and different sectors have different levels of PE, for example, the Cement sector has a PE of 38 and the Paint sector has a PE of 92, one should compare PE of same sector not different sector’s company.

Face Value-is the original value of share at the time of incorporation of a company. Example- Mr.A & Mr.B incorporated AB Private Limited and bought ₹2 Crore of equity capital and issued 20 lakh shares so face value will be calculated as- Equity Capital/No of outstanding share=Face Value 20000000/2000000=₹10. More face value means more chances of share split.

Book Value- Value of shares according to accounting(it consists the value of assets included). Equity Capital+Reserve Surplus/No of outstanding shares= Book Value. It should be treated as PE, and should be not too high.

Market Value- Share current price should justify the share’s PE in comparison with

Debt to Asset Ratio- Value of shares according to accounting(it consists the value of assets included) Equity Capital+Reserve Surplus/No of outstanding shares= Book Value. It should be less than 1.

Debt to Equity Ratio-compares the company’s total liabilities to shareholder’s equity. It should be less than 1, preferably around 0.5. More debt to equity ratio more risky company.

ROE- Return on equity means the return received from the amount invested by shareholders in the company. In short, return from capital invested (excluding debt)

ROCE- Return on capital employed means return received on the total capital devoted to the company including debt. Both ROE & ROCE should be more than 10%.

Current Ratio- is the ratio between current assets & current liabilities. Measures a company’s ability to pay short-term obligations. Should be more than 1.

Equity vs Reserve & Surplus- In this ratio equity should be stable or decreasing and Reserve & Surplus should be increasing over long periods. It shows the company has earned 4x amount with the investment of x amount.

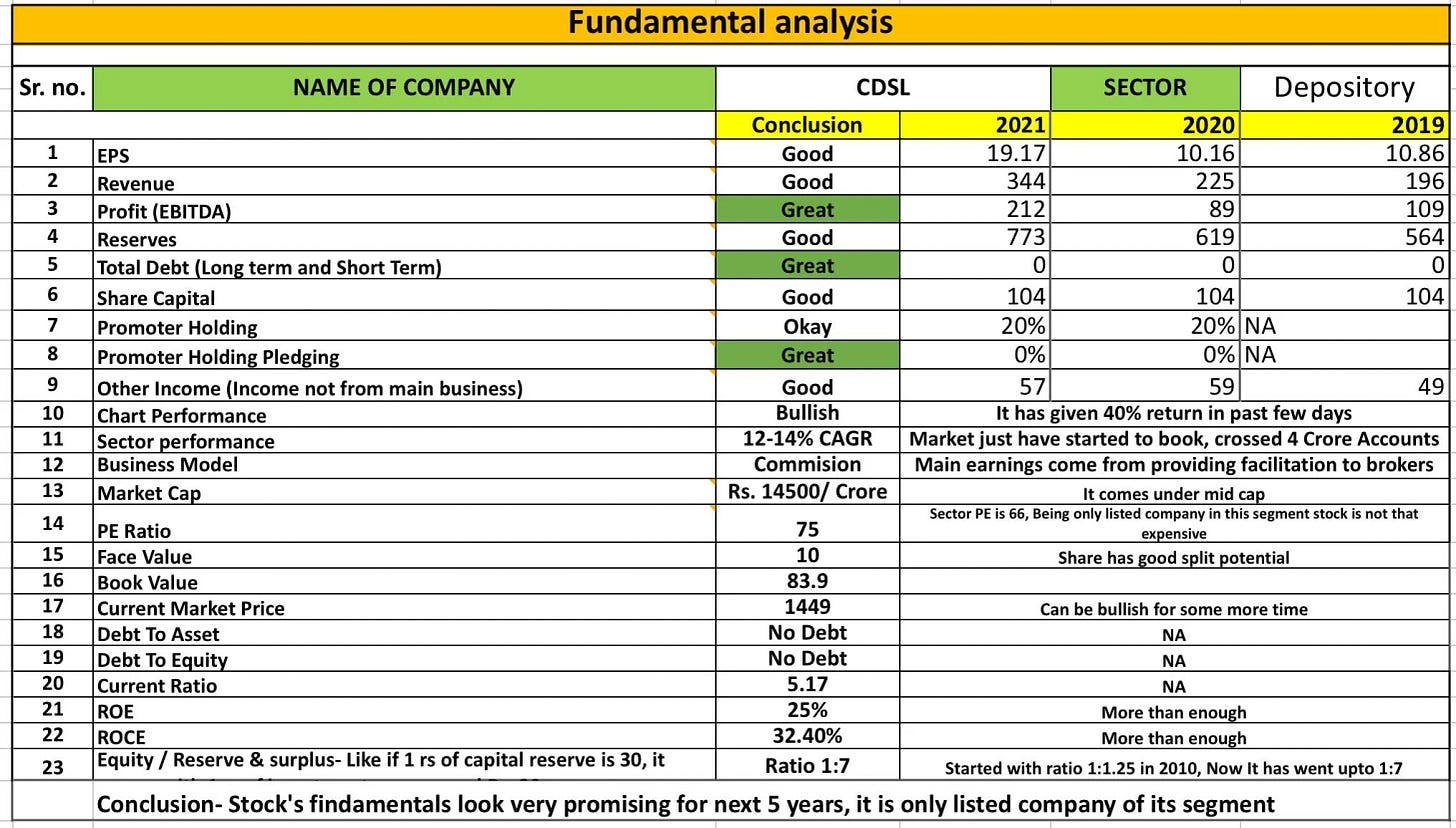

Last you can wrap with the conclusion, I have done a fundamental analysis of CDSL attached below to give you an idea-

This is the google drive link Fundamental Analysis Excel Format for download.

Tips-

Compare on year on year basis to get a broad or long-term view, as quarterly results created noise

Screener.in is best suited for this excel format, try not to use multiple sites for data as different sites show different numbers based on their way of calculations

PE can be avoided in exceptional cases

Thank you for reading….