Founder

Radhakishan S. Damani was raised in Mumbai, his family used to live in single-room apartments and had a very humble beginning. He dropped out of college after 1 year of studying commerce at the University of Mumbai and started a ball bearing business. After his father’s death, who worked on Dalal Street, Damani left his business and became a stock market broker & investor. He made crazy money by short-selling stocks inflated by the infamous Harshad Mehta in the early 1990s. In 1999, he operated a franchise of Apna Bazaar, a cooperative departmental store in Mumbai but was not happy with its business model. He quit the stock market and started his hypermarket chain DMart in 2002 and this is how DMart was founded.

As we know DMart is a retail hypermarket chain that has 284 stores across 10 states and 1 union territory, clocking ₹30000 crores of revenue and ₹1600 profit after tax. It offered its IPO in March 2017 at a price of ₹299/share which was listed with a premium of 104%, fast forward to 2021 share is trading around ₹4434 per share making Damani the 4th richest Indian. Let’s have a look at their business model, and how they achieved it.

Business Model

DMart is known for its discount policies, where other retail chains give discounts on festivals or special days, they give discounts on a daily or weekly basis. How do they manage to undercut their competition?

1. Slotting Fee- DMart charges this fee for placing the product on their shelves or we can say it is a rental for listing products in their stores. It is a recurring fee that is taken from the brands, as a result, they pass on this fee directly to the end user as a discount.

2. Self-Owned Stores- DMart has an edge of not having the burden of paying rent every month or quarter from their revenue, they are down more than 80% of the stores they have. Of course, this is a slow process that’s why it took almost two decades to reach the brand where it is now.

3. On-Time Payment Discount- Firstly, DMart tries to buy products directly from manufacturers, eliminating the cost of middlemen in between. Second, other retail chains pay manufacturers or middlemen after 30-90 days of delivery of products. If a manufacturer delivers soap to a retail store, the manufacturer or middlemen will get the payment after 30-90 days which is kind off painful🥲, whereas DMart pays it in 7 days and demands discounts in return for doing early payment and then pass on to the customer.

4. Volume Discount- DMart has successfully built a cycle where they sell more quantity and gets a good discount on bulk buying of products and because of good discounts they tend to sell more and more this cycle keeps going on. To give you an idea here is the inventory turnover of different chains. (Inventory turnover means a cycle of filling and emptying the inventory in one year.)

This means DMart refills its inventory 14 times a year. This shows how great they are in terms of volume.

5. Regional Products- This policy is just like a cherry on top. Our India is famous for its diversity, you can find different food after a few 100 km. So they took advantage of this and sell regional products which are already popular in that particular region, this way they completely eliminate the need of going to other local shops.

6. Expense & Area Optimisation- This brand is known for its discount and this is the vision they have been working on. They do a lot of optimization in their store like minimal decoration, keeping products that are smaller in size so area usage can be minimized, lesser staff, trying to use clean energy, and so on. Their vision is less luxury and more discounts which target the middle class.

Products categories

-Food- Groceries, Staples, Processed Foods, Dairy, Frozen Products, Beverages & Confectionery, Fruit & Vegetables.

-Non-Food (FMCG)- Home Care Products, Personal Care Products, Toiletries, and other products.

-General Merchandise & Apparel- Bed, Bath, Toys & Games, Crockery, Plastic Goods, Garments Footwear, Utensils, and Home Appliances.

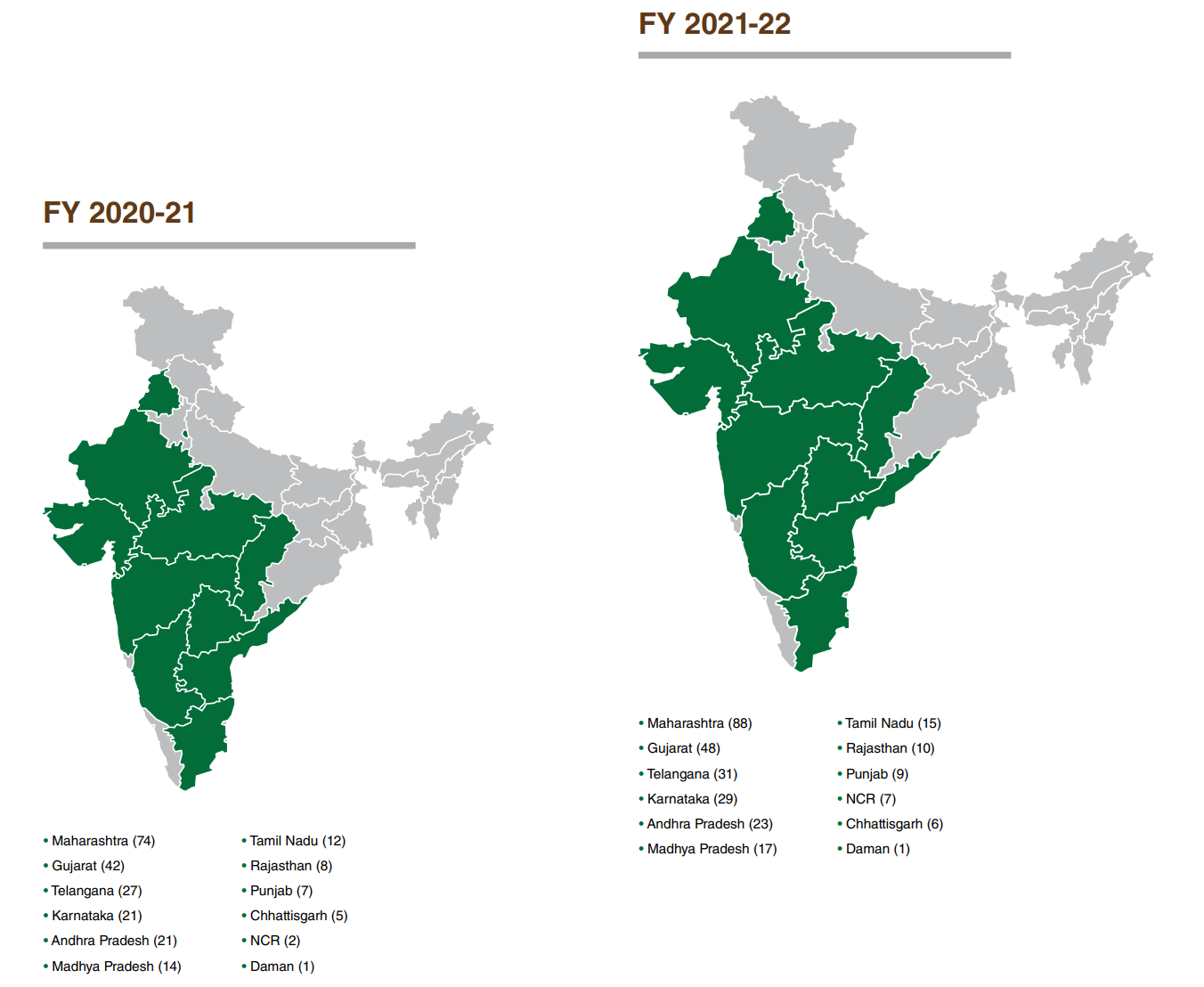

Expansion of the stores since the inception of DMart

Some boring numbers

Asset Turnover- It has been one of the highest in the industry. It means the company has been able to generate ₹310 of revenue with ₹100 of assets which again shows optimization of the chain.

Revenue & Profit- Has not seen a decline apart from covid years.

Shareholding pattern

Conclusion

R. Damani has built a high-value company that is highly optimized, giving the best discount and still able to make a hell lot of profit. Promoter holds 74.99% of ownership in the company and 63% of revenue comes from Maharashtra only which shows the company has a lot of potential for the rest of India. This company showed us how businesses can undercut the competition with deep pockets and this is why DMart has given more than 10 times of return to its investors in a short span of 3 years which includes covid times as well.

However, the stock is trading at 21.0 times its book value and though the company is reporting repeated profits, it is not paying out the dividend.

You can read the annual report FY22 on this link.

That is all for today. See you next time!

Very nice analysis, thanks for posting